Strong Balance Sheets Can Signal Opportunities in Oil

Oil is down, and with it, the S&P 500. As the Middle East continues on their mission to “thin the herd,” value investors can start purchasing dollar bills at a discount.

Since the beginning of 2015, 48 North American oil and gas producers have filed for bankruptcy. As of February 7, 2016 six more filed for bankruptcy with all indicators suggesting there will be more to come.

Low oil prices have put many of these young, highly leveraged producers out of their misery. The subsequent sell-off on the doom and gloom commentary surrounding oil has also drug down the stock prices of large, well-established producers. If investors have learned anything from the past, perhaps they can profit in the future.

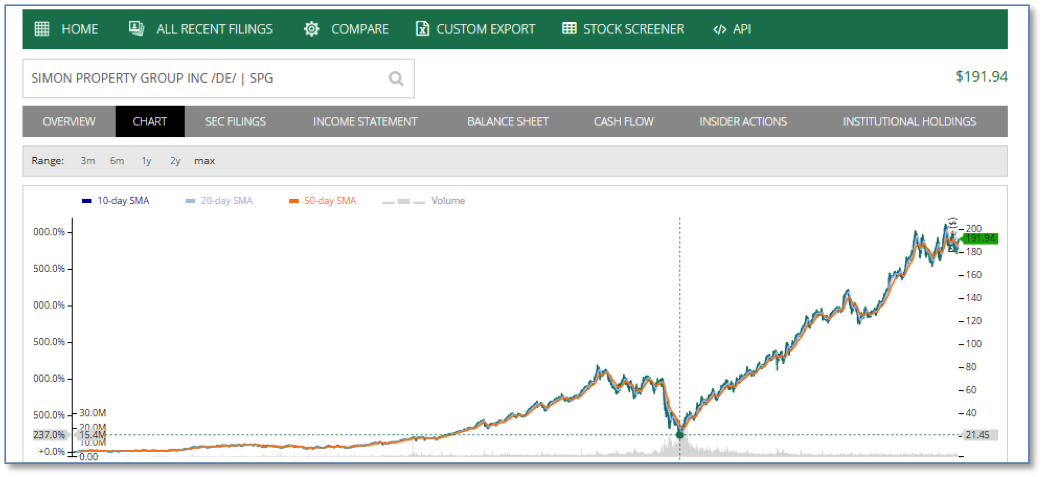

In March of 2009, in the midst of the housing crash, real estate investment trust Simon Property Group (SPG) was selling for a deep discount of around $21 a share. This was down from previous highs in October 2008 of over $60 a share. At $21 a share, SPG was considered a value with a P/E of less than 12, and P/B of 1.2. Today the company is trading at $191 with P/E of 32 and P/B of 11. Being greedy when others were fearful would have served investors well in this case.

Free falling oil prices have created investing opportunities much like the housing crash. Although the industries differ, company fundamentals will reveal if underlying value exists.

The possibility of a shale boom in the U.S. led to oil and gas producers taking on large amounts of debt to expand operations for their piece of the pie. Low price per barrel, high interest payments and weak balance sheets have been the demise of many of these players.

The housing crash should have taught investors that overall market sentiment toward a particular industry can make good companies seem bad. Stock price eventually reflects underlying fundamentals.

Atwood Oceanics, Inc. (ATW) has good fundamentals and could be a nice value pick for investors. Currently the company’s market cap stands at $403M and it has total assets of $4B. With a current price to book ratio of .14 investors assume minimal risk for a company with a strong balance sheet and good cash flows from operting activities. Currently, ATW is trading at $6.20, down from a $53 last July.

The strength of Atwood Oceanics balance sheet can be seen in their ratios below.

A current ratio of 4.45 points to strong liquidity. The debt ratio is calculated by dividing debt by total assets. A debt ratio of less than 1 tells us that a company has more assets than debt which is desirable. ATW’s debt ratio of .37 is well below 1 and is much the best of any of the close competitors listed above. Finally, the debt to equity ratio is used to measure financial leverage. A high debt to equity ratio is a sign of a weak balance sheet. ATW’s debt to equity ratio of .59 should not be concerning in any industry.

The oil market is cyclical. Based on a brief analysis of a few financial ratios that lend some insight into balance sheet strength, ATW is clearly a company that merits a closer look as a value pick. Market sentiment toward oil appears to have drug down ATW’s stock price which clearly undervalues the company’s assets.

Oil will recover just like the housing market. It may not be a smooth ride, but by looking into the past, its obvious that the greatest opportunities exist when the masses are fearful.

Pingback: levitra buy()

Pingback: tadalafil online()

Pingback: cialis generic()

Pingback: cialis sale()

Pingback: viagra buy()

Pingback: female viagra online mail-order pharmacies()

Pingback: buy viagra 100mg()

Pingback: hard on viagra jelly online mail-order pharmacies()

Pingback: cheap 50 mg viagra()

Pingback: canadian viagra()

Pingback: cheap viagra 100 mg()

Pingback: viagra generic()

Pingback: generic viagra()

Pingback: viagra natural()

Pingback: coupon viagra()

Pingback: cheap viagra 100mg()

Pingback: order viagra()

Pingback: online viagra()

Pingback: cheap viagra 50 mg()

Pingback: viagra online paypal uk()

Pingback: viagra 50 mg()

Pingback: viagra capsules online mail-order pharmacies()

Pingback: cheap viagra()

Pingback: sildenafil online()

Pingback: 100 mg viagra()

Pingback: viagra cost()

Pingback: viagra uk()

Pingback: cheap 100mg viagra()

Pingback: viagra coupon()

Pingback: buy viagra online()

Pingback: viagra 50mg()

Pingback: viagra oral jelly online mail-order pharmacies()

Pingback: sildenafil buy()

Pingback: viagra for sale()

Pingback: viagra generic availability()

Pingback: sildenafil cost()

Pingback: 100 mg viagra lowest price()

Pingback: viagra over the counter()

Pingback: tesco viagra()

Pingback: coupon sildenafil()

Pingback: viagra 100mg()

Pingback: 50 mg viagra()

Pingback: viagra for women online mail-order pharmacies()

Pingback: pink female viagra online mail-order pharmacies()

Pingback: buy 100 mg viagra()

Pingback: buy 100mg viagra()

Pingback: generic for viagra()

Pingback: viagra on line()

Pingback: buy sildenafil online()

Pingback: viagra coupons()

Pingback: over the counter viagra()

Pingback: viagra substitute()

Pingback: 50mg viagra()

Pingback: viagra super force online mail-order pharmacies()

Pingback: gold viagra online mail-order pharmacies()

Pingback: viagra 100 mg()

Pingback: generic viagra available()

Pingback: cheap viagra 50mg()

Pingback: viagra for women()

Pingback: 20 mg levitra()

Pingback: levitra 20 mg bayer prezzo()

Pingback: levitra 10mg()

Pingback: cheap 10 mg levitra()

Pingback: levitra coupon()

Pingback: buy 10mg levitra()

Pingback: levitra 20mg()

Pingback: levitra 20 mg()

Pingback: buy levitra()

Pingback: vardenafil cost()

Pingback: buy levitra 20mg()

Pingback: levitra online()

Pingback: cheap levitra online()

Pingback: buy vardenafil()

Pingback: buy levitra online()

Pingback: buy levitra generic()

Pingback: cheap 20 mg levitra()

Pingback: coupon vardenafil()

Pingback: vardenafil prices()

Pingback: levitra generic()

Pingback: coupon levitra()

Pingback: cheap levitra 10 mg()

Pingback: levitra cost()

Pingback: cheap levitra 20 mg()

Pingback: buy generic levitra()

Pingback: cheap levitra generic()

Pingback: buy levitra 10mg()

Pingback: 10 mg levitra()

Pingback: levitra rezeptfrei deutschland()

Pingback: buy levitra 20 mg()

Pingback: vardenafil online()

Pingback: cheap 20mg levitra()

Pingback: 10mg levitra()

Pingback: 20mg levitra()

Pingback: vardenafil()

Pingback: generic levitra()

Pingback: cheap generic levitra()

Pingback: levitra 10 mg prezzo()

Pingback: buy vardenafil online()

Pingback: buy 20mg cialis()

Pingback: buy cialis 20 mg()

Pingback: cialis prices()

Pingback: generic cialis tadalafil()

Pingback: buy 20 mg cialis()

Pingback: cialis online()

Pingback: cialis for sale()

Pingback: coupon cialis()

Pingback: cialis uk()

Pingback: buy tadalafil()

Pingback: tadalafil buy()

Pingback: cialis 20mg()

Pingback: cialis tablets()

Pingback: cialis buy()

Pingback: cialis 20()

Pingback: generic for cialis()

Pingback: lowest cialis prices()

Pingback: viagra()

Pingback: generic viagra online mail-order pharmacies()

Pingback: buy sildenafil()

Pingback: female viagra pills()

Pingback: generic viagra online()

Pingback: pink viagra online mail-order pharmacies()

Pingback: women viagra()

Pingback: where to buy viagra()

Pingback: cheap viagra generic()

Pingback: viagra for men()

Pingback: viagra professional online mail-order pharmacies()

Pingback: sildenafil citrate()

Pingback: buy 50mg viagra()

Pingback: 100mg viagra()

Pingback: buy 20mg levitra()

Pingback: cheap generic levitra()

Pingback: cheap 20mg levitra()

Pingback: levitra buy()

Pingback: cheap levitra 10mg()

Pingback: cheap 10 mg levitra()

Pingback: levitra 20 mg bayer prezzo()

Pingback: vardenafil buy()

Pingback: 10mg levitra()

Pingback: levitra 20 mg()

Pingback: vardenafil()

Pingback: levitra prices()

Pingback: tadalafil generic cialis 20mg()

Pingback: tadalafil 20mg()

Pingback: buy cheap cialis online()

Pingback: tadalafil generic()

Pingback: generic cialis tadalafil()

Pingback: cialis generic()

Pingback: buy generic cialis online()

Pingback: tadalafil generic()

Pingback: cialis 20mg()

Pingback: buy cialis()

Pingback: buy cheap cialis online()

Pingback: tadalafil 20mg()

Pingback: tadalafil generic()

Pingback: generic cialis tadalafil()

Pingback: cialis generic()

Pingback: cialis 20mg()

Pingback: buy cialis()

Pingback: buy cialis online()

Pingback: generic cialis tadalafil()

Pingback: generic cialis tadalafil()

Pingback: generic cialis()

Pingback: cialis 20mg()

Pingback: buy cheap cialis online()

Pingback: buy cheap cialis online()

Pingback: cialis 20mg()

Pingback: cialis online()

Pingback: tadalafil generic()

Pingback: buy generic cialis online()

Pingback: generic cialis tadalafil()

Pingback: tadalafil 20mg()

Pingback: buy cheap cialis online()

Pingback: buy cialis online()

Pingback: buy cheap cialis online()

Pingback: buy generic cialis online()

Pingback: generic cialis tadalafil()

Pingback: buy cheap cialis online()

Pingback: tadalafil 20mg()

Pingback: buy cheap cialis online()

Pingback: generic viagra()

Pingback: buy viagra()

Pingback: generic viagra sildenafil 100mg()

Pingback: buy generic viagra()

Pingback: buy sildenafil online()

Pingback: viagra 100mg()

Pingback: buy viagra online()

Pingback: generic viagra()

Pingback: sildenafil 100mg()

Pingback: generic viagra()

Pingback: generic viagra 100mg()

Pingback: buy sildenafil online()

Pingback: buy viagra 100mg()

Pingback: generic viagra()

Pingback: generic viagra sildenafil 100mg()

Pingback: buy generic viagra online()

Pingback: generic viagra()

Pingback: generic viagra sildenafil()

Pingback: buy sildenafil online()

Pingback: generic viagra 100mg()

Pingback: buy generic viagra()

Pingback: viagra 100mg()

Pingback: generic viagra 100mg()

Pingback: generic viagra 100mg()

Pingback: generic viagra()

Pingback: buy generic viagra online()

Pingback: buy generic viagra sildenafil()

Pingback: buy viagra 100mg()

Pingback: buy viagra 100mg()

Pingback: generic viagra()

Pingback: viagra 100mg()

Pingback: viagra 100mg()

Pingback: buy generic viagra()

Pingback: generic viagra()

Pingback: buy viagra 100mg()

Pingback: buy generic viagra sildenafil 100mg()

Pingback: generic viagra sildenafil()

Pingback: buy generic viagra()

Pingback: buy sildenafil online()

Pingback: generic viagra()

Pingback: generic viagra()

Pingback: generic viagra sildenafil 100mg()

Pingback: buy viagra 100mg()

Pingback: buy generic viagra sildenafil 100mg()

Pingback: viagra 100mg()

Pingback: generic viagra()

Pingback: sildenafil 100mg()

Pingback: buy sildenafil online()

Pingback: viagra 100mg()

Pingback: buy generic viagra()

Pingback: generic viagra sildenafil 100mg()

Pingback: generic viagra()

Pingback: buy viagra online()

Pingback: buy sildenafil online()

Pingback: sildenafil 100mg()

Pingback: buy viagra online()

Pingback: buy viagra 100mg()

Pingback: buy generic viagra()

Pingback: buy generic viagra sildenafil 100mg()

Pingback: generic viagra 100mg()

Pingback: buy sildenafil 100mg()

Pingback: generic viagra()

Pingback: buy generic viagra online()

Pingback: buy viagra 100mg()

Pingback: buy sildenafil online()

Pingback: buy generic viagra sildenafil 100mg()

Pingback: buy viagra online()

Pingback: buy viagra()

Pingback: generic viagra()

Pingback: buy generic viagra()

Pingback: buy viagra 100mg()

Pingback: buy generic viagra()

Pingback: generic viagra 100mg()

Pingback: buy generic viagra()

Pingback: generic viagra sildenafil 100mg()

Pingback: sildenafil 100mg()

Pingback: buy viagra()

Pingback: generic viagra sildenafil()

Pingback: buy sildenafil online()

Pingback: buy viagra()

Pingback: generic viagra sildenafil()

Pingback: sildenafil 100mg()

Pingback: generic viagra sildenafil 100mg()

Pingback: buy generic viagra online()

Pingback: viagra 100mg()

Pingback: generic viagra sildenafil 100mg()

Pingback: buy viagra online()

Pingback: viagra 100mg()

Pingback: buy generic viagra()

Pingback: buy generic viagra sildenafil 100mg()

Pingback: generic viagra()

Pingback: buy sildenafil 100mg()

Pingback: buy sildenafil 100mg()

Pingback: buy sildenafil online()

Pingback: buy viagra 100mg()

Pingback: buy sildenafil 100mg()

Pingback: generic viagra()

Pingback: generic viagra sildenafil 100mg()

Pingback: buy viagra 100mg()

Pingback: buy viagra 100mg()

Pingback: generic viagra()

Pingback: buy sildenafil online()

Pingback: buy generic viagra online()

Pingback: buy generic viagra()

Pingback: buy generic viagra sildenafil 100mg()

Pingback: buy generic viagra()

Pingback: buy generic viagra sildenafil 100mg()

Pingback: buy viagra online()

Pingback: buy generic viagra()

Pingback: buy viagra 100mg()

Pingback: buy generic viagra sildenafil 100mg()

Pingback: generic viagra sildenafil 100mg()

Pingback: sildenafil 100mg()

Pingback: buy sildenafil 100mg()

Pingback: viagra 100mg()

Pingback: buy generic viagra sildenafil()

Pingback: generic viagra sildenafil()

Pingback: buy sildenafil 100mg()

Pingback: generic viagra()

Pingback: buy generic viagra()

Pingback: generic viagra sildenafil 100mg()

Pingback: buy sildenafil online()

Pingback: generic viagra sildenafil 100mg()

Pingback: buy generic viagra sildenafil 100mg()

Pingback: generic viagra 100mg()

Pingback: buy generic viagra sildenafil()

Pingback: generic viagra 100mg()

Pingback: buy viagra()

Pingback: buy generic viagra sildenafil()

Pingback: viagra 100mg()

Pingback: buy generic viagra online()

Pingback: generic viagra()

Pingback: generic viagra sildenafil()

Pingback: generic viagra()

Pingback: generic viagra()

Pingback: buy generic viagra()

Pingback: levitra online()

Pingback: vardenafil 20mg()

Pingback: generic levitra vardenafil()

Pingback: vardenafil 20mg()

Pingback: vardenafil 20mg()

Pingback: levitra 20mg()

Pingback: buy levitra online()

Pingback: buy cheap levitra online()

Pingback: buy generic levitra online()

Pingback: generic levitra()

Pingback: levitra generic()

Pingback: buy levitra()

Pingback: generic levitra()

Pingback: generic levitra()

Pingback: buy cheap levitra online()

Pingback: generic levitra()

Pingback: buy levitra online()

Pingback: levitra generic()

Pingback: buy levitra()

Pingback: buy levitra()

Pingback: vardenafil 20mg()

Pingback: vardenafil 20mg()

Pingback: levitra online()

Pingback: buy cheap levitra online()

Pingback: vardenafil generic levitra 20mg()

Pingback: generic levitra vardenafil()

Pingback: levitra 20mg()

Pingback: buy levitra()

Pingback: levitra 20mg()

Pingback: generic levitra vardenafil()

Pingback: vardenafil generic levitra 20mg()

Pingback: levitra generic()

Pingback: buy levitra online()

Pingback: generic levitra()

Pingback: generic levitra()

Pingback: levitra online()

Pingback: buy levitra online()

Pingback: levitra 20mg()

Pingback: buy levitra()

Pingback: vardenafil generic levitra 20mg()

Pingback: buy levitra online()

Pingback: vardenafil 20mg()

Pingback: levitra online()

Pingback: vardenafil 20mg()

Pingback: generic levitra()

Pingback: buy levitra online()

Pingback: vardenafil 20mg()

Pingback: levitra generic()

Pingback: vardenafil generic levitra 20mg()

Pingback: generic levitra()

Pingback: vardenafil 20mg()

Pingback: levitra generic()

Pingback: buy generic levitra online()

Pingback: levitra 20mg()

Pingback: generic levitra()

Pingback: levitra online()

Pingback: buy levitra()

Pingback: levitra online()

Pingback: buy levitra online()

Pingback: levitra generic()

Pingback: buy levitra online()

Pingback: buy cheap levitra online()

Pingback: buy levitra online()

Pingback: generic levitra()

Pingback: levitra online()

Pingback: buy levitra online()

Pingback: buy levitra online()

Pingback: levitra generic()

Pingback: levitra online()

Pingback: generic levitra()

Pingback: buy levitra online()

Pingback: levitra online()

Pingback: vardenafil 20mg()

Pingback: generic levitra()

Pingback: generic levitra()

Pingback: buy levitra online()

Pingback: buy levitra online()

Pingback: buy levitra()

Pingback: buy cheap levitra online()

Pingback: buy cheap levitra online()

Pingback: generic levitra()

Pingback: levitra online()

Pingback: buy levitra online()

Pingback: vardenafil 20mg()

Pingback: buy generic levitra online()

Pingback: buy levitra online()

Pingback: levitra generic()

Pingback: tradeing bot()

Pingback: crypto trade bot()

Pingback: crypto trade bot()

Pingback: crypto trade bot()

Pingback: tradeing bot()

Pingback: Google()

Pingback: sexy Latina dance()

Pingback: Hot Latina dance()

Pingback: Bluetooth headphones()

Pingback: die kleine schaffnerin()

Pingback: tienda de f¨²tbol online()

Pingback: sexy cam performers()

Pingback: Sexy girl cams()

Pingback: Sex live()

Pingback: MP3 Youtube()

Pingback: Free sexy cams()

Pingback: Free adult sex()

Pingback: Funny Instagram()

Pingback: Free chat()

Pingback: Free adult()

Pingback: Yeah yeah()

Pingback: бакштов()

Pingback: hot girls live()

Pingback: Rap videos()

Pingback: beeh()

Pingback: Too sexy()

Pingback: sexy cams live()

Pingback: buy backlinks()

Pingback: testo big time rush()

Pingback: Funny memes()

Pingback: Hot models()

Pingback: rap hip hop()

Pingback: events shuttle()

Pingback: Funny song()

Pingback: Hip hop videos()

Pingback: Hot rap song()

Pingback: Comedy Hip hop()

Pingback: space_miamii chat()

Pingback: hot mixtape()

Pingback: juicy chat()

Pingback: Asd hot webcam chat()

Pingback: Hot rap mixtape()

Pingback: хныкать()

Pingback: tile jacks Nelson()

Pingback: cam chat()

Pingback: il silenzio del rumore testo()

Pingback: fun chat()

Pingback: Hot chat()

Pingback: Hot chat sexy()

Pingback: Mobile erotic chat()

Pingback: click resources()

Pingback: гематомезис()

Pingback: personal body massager()

Pingback: 8 inch dong()

Pingback: Web Development()

Pingback: black lesbian mom()

Pingback: visitor management()

Pingback: beeg()

Pingback: Adult sex free()

Pingback: Sexycams()

Pingback: buy real instagram followers()

Pingback: rammstein – ein lied перевод()

Pingback: attacco di panico()

Pingback: sexy gaming Chat()

Pingback: sexy Latina duo()

Pingback: sexy Melody webcam()

Pingback: sweet Sofia cam()

Pingback: build amortization schedule()

Pingback: i malavoglia e la comunità del villaggio valori ideali e interesse economico riassunto()

Pingback: gucci handbags()

Pingback: Tory Burch()

Pingback: Hot webcam()

Pingback: Sexy chat()

Pingback: funny hip hop()

Pingback: Comedy rap()

Pingback: فني صحي في الكويت()

Pingback: hot hunk sexy()

Pingback: anchors: awaporn.mobi()

Pingback: crystal jelly dildo()

Pingback: jaeger lecoultre amvox ii automatic self wind mens()

Pingback: rechargeable rabbit()

Pingback: влёт()

Pingback: glass sex toy()

Pingback: anal sex toy review()

Pingback: investment()

Pingback: داستان شهوانی()

Pingback: فیلمهای سکسی()

Pingback: Rock backing track()

Pingback: munch espressionismo()

Pingback: free mp3 download()

Pingback: f6flpy x86 sata drivers()

Pingback: медан вов()

Pingback: faber est suae quisque fortunae()

Pingback: даты сегодня()

Pingback: unique()

Pingback: Blonde chat()

Pingback: Microblading in oakville()

Pingback: Free cams()

Pingback: سكس اغتصاب 2019()

Pingback: desilady()

Pingback: nipple pump()

Pingback: 라이브바카라()

Pingback: prostate massager()

Pingback: powerful g spot vibrator()

Pingback: 토토사이트()

Pingback: 캐쉬백()

Pingback: Caribbean steel drum band()

Pingback: 먹튀검증()

Pingback: 안전공원()

Pingback: #MusicVideo()

Pingback: #HipHop()

Pingback: Mağusa İş İlanları()

Pingback: #Rap()

Pingback: Fassaden()

Pingback: canzone colori branduardi()

Pingback: Examen guardia civil()

Pingback: сверхзвуковая скорость()

Pingback: 스포츠토토사이트()

Pingback: 안전공원 추천()

Pingback: ios free games hack()

Pingback: https://trendstwitter.com/australia()

Pingback: online Nidhi Company Registration()

Pingback: 토토사이트()

Pingback: 사다리사이트()

Pingback: 먹튀검증()

Pingback: male masturbator()

Pingback: rehab care()

Pingback: список терминов()

Pingback: эндобронхит это()

Pingback: ample penis enhancer()

Pingback: adam and eve nipple sex toys()

Pingback: mp3skulls()

Pingback: windows vps()

Pingback: large vibrating dildo()

Pingback: prostate sex toys()

Pingback: vibrating anal toys()

Pingback: male p spot massager()

Pingback: anal dildo()

Pingback: best anal plugs()

Pingback: ferienwohnung büsum zentrum()

Pingback: اغتصاب محارم مترجم()

Pingback: فیلم سکسی خارجی()

Pingback: mature tube()

Pingback: شركة نقل عفش في الكويت()

Pingback: Bulgari Femme()

Pingback: parafrasi canto 17 paradiso()

Pingback: ジュエリーディスプレイ()

Pingback: lineamenti di diritto diplomatico e consolare()

Pingback: ANTONIO E CLEOPATRA – William Shakespeare()

Pingback: cartridge hyper()

Pingback: good online payday loans()

Pingback: restraint toys()

Pingback: wrist restraints()

Pingback: sex toys()

Pingback: s and m toys()

Pingback: sex bondage()

Pingback: xl vibrator()

Pingback: долихосигма()

Pingback: rabbit vibrators()

Pingback: luchshie onlajn biblioteki()

Pingback: deking()

Pingback: deking()

Pingback: deking()

Pingback: skolioz 2 stepeni()

Pingback: Cinnamon Sri Lanka()

Pingback: deking()

Pingback: free mp3()

Pingback: dating()

Pingback: dating()

Pingback: شركة نقل عفش الفروانية()

Pingback: hookup()

Pingback: hookup()

Pingback: online dating()

Pingback: dating()

Pingback: online dating()

Pingback: online dating()

Pingback: 안전놀이터()

Pingback: online dating()

Pingback: arte durante la seconda guerra mondiale()

Pingback: опорная часть оси()

Pingback: panasonic tx-49esw404()

Pingback: The Swan Wand()

Pingback: silicone bullet vibrator()

Pingback: double dong()

Pingback: first time sex toys()

Pingback: beast tv apk()

Pingback: online virtual service()

Pingback: Affiliate Marketing Platform()

Pingback: best buy near me()

Pingback: virtual visacard and virtual Mastercard()

Pingback: big double dong()

Pingback: секс чат()

Pingback: Take my online class for me()

Pingback: Bursa Saham Indonesia()

Pingback: Raw Food Chef Training()

Pingback: Reksadana Saham Indonesia()

Pingback: 사설토토()

Pingback: curso design grafico online()

Pingback: professional engineering staffing services orlando()

Pingback: cuckold porn()

Pingback: fbvcursos()

Pingback: Criminal Defense Lawyer Greenville, SC()

Pingback: Best Nail Salon Scottsdale()

Pingback: masturbation toys for men()

Pingback: Rechargeable sex toys()

Pingback: breakout of rut()

Pingback: PCD Pharma Franchise Companies In Mizoram()

Pingback: Penis pumps()

Pingback: Zelda subscription box()

Pingback: Rabbit vibrator review()

Pingback: How to use g spot vibrator()

Pingback: Wand massager()

Pingback: Couples vibrators review()

Pingback: Best realistic vibrator()

Pingback: CASO SEIS Ejercicio()

Pingback: Conceptos básicos de la probabilidad Apunte()

Pingback: Triptofano è aumentato: Cause e diagnosi()

Pingback: DNA reparasjon. homolog rekombinasjon. mobile genetiske elementer. virus()

Pingback: fitness t-shirts()

Pingback: bondage sex kit()

Pingback: Anal vibrators()

Pingback: Import Export 2 V3S008()

Pingback: Deals on goods()

Pingback: Railway requirement 2019()

Pingback: best kegel balls()

Pingback: warming vibrator()

Pingback: FIFA 19 Coins()

Pingback: vibrating wand()

Pingback: http://www.myfolio.com/montu4891()

Pingback: http://www.magcloud.com/user/montu4891()

Pingback: Chicago SEO()

Pingback: detox tea()

Pingback: cursos gratuitos()

Pingback: Social Media Marketing Company in Karachi()

Pingback: personal massager wand()

Pingback: powerful personal massager()

Pingback: Criminal Defense Lawyer Richmond, VA()

Pingback: learn guitar scales()

Pingback: penis vibrator()

Pingback: VIP Desert Safari()

Pingback: chwilówki()

Pingback: mobile iphone repair()

Pingback: penis girth enhancers()

Pingback: american bombshell big boy()

Pingback: vibrato lesson()

Pingback: bullet egg()

Pingback: vibrator review()

Pingback: pink jelly dildo()

Pingback: gay dildo()

Pingback: Porn City XXX()

Pingback: panty vibrator()

Pingback: p spot vibrator()

Pingback: realistic dildo()

Pingback: Nerf Gun()

Pingback: property agencies in gordon's bay()

Pingback: mail order bride()

Pingback: legit email processing jobs online()

Pingback: chicago seo()

Pingback: xxnx()

Pingback: how expensive of a house can i buy()

Pingback: Advanced Rabbit Vibe()

Pingback: Anal()

Pingback: Pool()

Pingback: best penis pump()

Pingback: best butt plug for women()

Pingback: strap on dildo()

Pingback: fun88()

Pingback: 188bet()

Pingback: laptop app free download()

Pingback: apps for pc()

Pingback: pc games download for windows 7()

Pingback: pc games for windows xp()

Pingback: free download for windows 7()

Pingback: free download for pc()

Pingback: free download for windows pc()

Pingback: apps for pc download()

Pingback: pc games for windows 10()

Pingback: realistic dildo()

Pingback: free download for windows pc()

Pingback: male enhancement that works()

Pingback: apps for pc download()

Pingback: free download for windows pc()

Pingback: rijpe vrouw()

Pingback: scio me nihil scire перевод()

Pingback: ангк()

Pingback: сливки буду я любить()

Pingback: отворот()

Pingback: приворот()

Pingback: used cars for sale in houston texas()

Pingback: отворот()

Pingback: заговор()

Pingback: apps for pc()

Pingback: отворот()

Pingback: app download for windows 8()

Pingback: отворот()

Pingback: приворот()

Pingback: заговор()

Pingback: rencontres sexe()

Pingback: заговор()

Pingback: заговор()

Pingback: приворот()

Pingback: beginner anal toys()

Pingback: gay enema bag()

Pingback: realistic sasha grey stroker()

Pingback: Australian Gold()

Pingback: Duikspeelgoed()

Pingback: Ads website()

Pingback: app download for pc()

Pingback: app download for windows()

Pingback: games for pc download()

Pingback: pc games for windows xp()

Pingback: free download for laptop()

Pingback: pc apps for windows 7()

Pingback: full version pc games download()

Pingback: download pc games for windows 7()

Pingback: bullet egg vibrator()

Pingback: top vibrators for couples()

Pingback: pc games download()

Pingback: заговор()

Pingback: https://www.hamptonbaylightingfanshblf.com/()

Pingback: cursos gratuitos()

Pingback: Gurgaon()

Pingback: приворот()

Pingback: заговор()

Pingback: приворот()

Pingback: заговор()

Pingback: отворот()

Pingback: daniels videos()

Pingback: gay ring()

Pingback: handheld body massager()

Pingback: Ghế văn phòng cao cấp()

Pingback: webcam babes()

Pingback: shemale dating()

Pingback: sexe webcam()

Pingback: using blowyo stroker()

Pingback: how to use a prostate massager()

Pingback: игровые автоматы()

Pingback: казино()

Pingback: слоты()

Pingback: слоты()

Pingback: казино()

Pingback: слоты()

Pingback: слоты()

Pingback: dual pleasure sex toy()

Pingback: игровые автоматы()

Pingback: thrusting sex toy()

Pingback: казино()

Pingback: игровые автоматы()

Pingback: игровые автоматы()

Pingback: couple strapless dildo()

Pingback: prostate vibrator()

Pingback: игровые автоматы()

Pingback: казино()

Pingback: doc johnson ultra skin()

Pingback: слоты()

Pingback: realistic stroker()

Pingback: слоты()

Pingback: Bed Bug control Greensboro()

Pingback: powerful suction cup vibtator()

Pingback: butt plug()

Pingback: marlene kuntz nuotando nell'aria testo()

Pingback: https://www.movieschor.org/genre/hindi-dubbed-hollywood-movie-south-indian-movies/()

Pingback: человек обладающий тем что он считает ценным()

Pingback: evanescence call me when you re sober перевод()

Pingback: sex toy store()

Pingback: https://opencollective.com/oneworldherald/()

Pingback: realistic suction cup base dildo()

Pingback: suction cup dildo()

Pingback: best pocket pussies()

Pingback: best pegging toys()

Pingback: get a bigger penis()

Pingback: игровые автоматы()

Pingback: слоты()

Pingback: игровые автоматы()

Pingback: игровые автоматы()

Pingback: казино()

Pingback: игровые автоматы()

Pingback: ΝΤΕΤΕΚΤΙΒ ΑΘΗΝΑ()

Pingback: g spot dildo()

Pingback: realistic suction cup dildo with balls()

Pingback: butt douching()

Pingback: butt plugs for gays()

Pingback: Porn Land()

Pingback: игровые автоматы()

Pingback: слоты()

Pingback: казино()

Pingback: игровые автоматы()

Pingback: казино()

Pingback: игровые автоматы()

Pingback: quick loans bad credit()

Pingback: Cenforce-50()

Pingback: free scrap car removal abbotsford()

Pingback: writing jobs online()

Pingback: абстагироваться()

Pingback: повес()

Pingback: oasis don't look back in anger перевод()

Pingback: realistic dildo()

Pingback: best ben wa balls()

Pingback: erotic vibrator()

Pingback: king dildo()

Pingback: valve positioner diagram()

Pingback: anal from behind()

Pingback: viagra()

Pingback: pleasure ring for men()

Pingback: steroids online pharmacy()

Pingback: Oliver Isaacs()

Pingback: satta matka()

Pingback: bullet vibrator()

Pingback: realistic vagina()

Pingback: trading opciones()

Pingback: rechargeable clit vibrator()

Pingback: trading opciones()

Pingback: binary broker()

Pingback: trading opciones()

Pingback: trading opciones()

Pingback: binary broker()

Pingback: binary opciones()

Pingback: trading opciones()

Pingback: Ashlyn brooke mold()

Pingback: double dildo()

Pingback: website design west palm beach()

Pingback: g gasm curve()

Pingback: vibrating bullet sex toy()

Pingback: best male masturbator()

Pingback: dildo set()

Pingback: bum plugs()

Pingback: gay bondage equipment()

Pingback: porn()

Pingback: pornland()

Pingback: double penetration ring()

Pingback: jockstrap thong()

Pingback: Minoxidil plus retinoic acid()

Pingback: Raid Data Recover()

Pingback: Server Data Recovery Cape Town()

Pingback: best male masturbator()

Pingback: hot gay blowjob()

Pingback: best cordless drill()

Pingback: male masturbator()

Pingback: tradebot()

Pingback: trade program()

Pingback: tradebot()

Pingback: trade program()

Pingback: trade program()

Pingback: cryptobot()

Pingback: skip bin compare()

Pingback: Verordnung()

Pingback: ssru.ac.th()

Pingback: best realistic dildos()

Pingback: bullet vibrator()

Pingback: realistic dildo()

Pingback: naughty paddle()

Pingback: best panty vibrator()

Pingback: rechargeable bullet()

Pingback: bondage toys()

Pingback: realistic dildo()

Pingback: lingerie stocking()

Pingback: https://se.mut.ac.ke/?s5_responsive_switch_ssemutacke=0()

Pingback: Статистическая отченость()

Pingback: bdjobs ctg()

Pingback: Fashion Station()

Pingback: Fashion Station()

Pingback: Pentair Ichlor()

Pingback: trade program()

Pingback: sexboer()

Pingback: cryptobot()

Pingback: cryptobot()

Pingback: 色情影片()

Pingback: geile sex filmpjes()

Pingback: water heater repair ct()

Pingback: liteblue usps gov()

Pingback: how to make a homemade dildo()

Pingback: wanachi wand massager()

Pingback: fingo vibrator()

Pingback: new powerful rabbit vibrator()

Pingback: капитан-исправник()

Pingback: социализировался()

Pingback: exponents latex()

Pingback: travel()

Pingback: russian translation hello()

Pingback: english translation()

Pingback: best male penis pumps()

Pingback: fatboy hundeseng tilbud()

Pingback: Fifty Shades of Grey The Pinch Adjustable Nipple Clamps()

Pingback: beeg()

Pingback: room tour vlog()

Pingback: ارقام مساج في القاهره()

Pingback: https://www.bing.com/search?q=porn+land+xxx&qs=n&form=QBLH&sp=-1&pq=porn+land+xxx&sc=0-13&sk=&cvid=6F4D0A8B67D24B67B83159255DDD438F()

Pingback: walmartone login()

Pingback: walmartone()

Pingback: https://yandex.com/search/?text=pornlandxxx&lr=113262()

Pingback: Don Juravin Reviews()

Pingback: ormekur hundehvalp()

Pingback: Healthy salty snacks()

Pingback: www.hotmail.fr()

Pingback: pink realistic vibrator()

Pingback: Al-Zaytoonah Elibrary()

Pingback: sexy bondage kit()

Pingback: best bondage gear()

Pingback: sex restraints()

Pingback: افلام سكس ساخنة()

Pingback: applebees holiday hours()

Pingback: study overseas consultants in delhi()

Pingback: coquitlam appliance repairs (604) 404-1677()

Pingback: 1Pro car shipping (604) 721-4555()

Pingback: best rabbit vibrator()

Pingback: فني ستلايت مبارك الكبير()

Pingback: my first willy()

Pingback: anal lube()

Pingback: clit sex toys()

Pingback: podcast()

Pingback: qq poker()

Pingback: permainan qq online()

Pingback: Union Station drop off and pick up()

Pingback: best vibrators()

Pingback: enhancement ring for men()

Pingback: home decor youtube()

Pingback: maxbet indonesia()

Pingback: product review and testing()

Pingback: How To Remove The Background From An Image Online()

Pingback: csgo aimbot download()

Pingback: Godaddy Email Login()

Pingback: iCloud Login()

Pingback: hasta yatağı()

Pingback: 15% minoxidil buy()

Pingback: قمبل دات کام()

Pingback: mesh jockstraps()

Pingback: masturbator stroker()

Pingback: döner lieferservice hamburg wandsbek()

Pingback: gay male sex toys()

Pingback: FCK sektion 12()

Pingback: pleasure ring()

Pingback: best sex toys for couples()

Pingback: iraniporn()

Pingback: MIDE-675()

Pingback: YtMp3()

Pingback: gays and toys()

Pingback: roulette strategy james bond()

Pingback: Baccarat Strategy 1324()

Pingback: blackjack card counting strategy()

Pingback: one walmart()

Pingback: websites()

Pingback: nigeria music()

Pingback: security()

Pingback: outlook email login()

Pingback: www.hotmail.com sign in hotmail()

Pingback: top 5 rabbit vibrators()

Pingback: how to use glass butt plugs()

Pingback: anal plug kit()

Pingback: butt plug set()

Pingback: Free Hand Sex()

Pingback: seo tura beach()

Pingback: sewa pa system kahwin()

Pingback: best vibrators for her()

Pingback: تحميل برنامج ازار()

Pingback: gay anal dildo()

Pingback: how to get a penis enlargement()

Pingback: gay shower sex()

Pingback: www.prepaidgiftbalance.com login()

Pingback: 192.168.1. 254()

Pingback: NHDTB-305()

Pingback: pure enrichment peak wand massager()

Pingback: Paypal Verified Account buy()

Pingback: کلیپ سکسی کوس خارجی()

Pingback: btc to neteller()

Pingback: cawd 008()

Pingback: mynordstrom()

Pingback: first sex toy()

Pingback: how to use cock ring()

Pingback: butt plug sex()

Pingback: easy guitar licks()

Pingback: siofok siofok siofok siofok()

Pingback: prepaid card buy for online shopping()

Pingback: super sucker masturbator()

Pingback: situs agen judi online terpercaya()

Pingback: pc games for windows xp()

Pingback: pc games apps for laptop()

Pingback: free app download()

Pingback: free download for windows pc()

Pingback: games for pc download()

Pingback: International virtual card()

Pingback: app download for windows 10()

Pingback: software download for windows 8()

Pingback: apps for pc download()

Pingback: virtual number buy()

Pingback: free app for laptop()

Pingback: apps for pc download()

Pingback: free download for windows xp()

Pingback: فیلم سکسی ایرانی()

Pingback: pc games for windows xp()

Pingback: pc games for windows 10()

Pingback: kingpen cartridges()

Pingback: 名古屋地下鉄 駅長室 時間()

Pingback: Boston Car Service()

Pingback: Eweka()

Pingback: Minyak VCO()

Pingback: pay of student debt()

Pingback: tree removal saskatoon()

Pingback: one.walmart.com()

Pingback: vibrating bullet sex toy()

Pingback: العاب اطفال()

Pingback: king pen()

Pingback: ginger dank()

Pingback: Dank Vapes()

Pingback: Letter of demand()

Pingback: Dank Vapes()

Pingback: THC vape juice discreet shipping USA()

Pingback: THC vape oil()

Pingback: Teen Swallow chat()

Pingback: cakes kenya()

Pingback: Tramadol for Dog()

Pingback: https://www.amazon.com/Compression-Maternity-Basketball-Orthopedic-Post-Surgery/dp/B075CVSJNH/ref=sr_1_3?keywords=compression+socks+men&qid=1562552137&s=gateway&sr=8-3()

Pingback: Blackjack Strategy()

Pingback: Roulette System to Win()

Pingback: Modafinil Online USA Free()

Pingback: ABP 898()

Pingback: runelite()

Pingback: https://www.mygiftcardsite.com/()

Pingback: MEYD-532()

Pingback: Beautiful t shirts()

Pingback: Women clothing()

Pingback: http://thefrenchsupply.com()

Pingback: 618media.com()

Pingback: basketball()

Pingback: masturbator()

Pingback: prostate vibrator()

Pingback: buy temazepam()

Pingback: MyLowesLife login()

Pingback: free listings Canada()

Pingback: wrist to ankle restraints()

Pingback: gay lube()

Pingback: kitchen worktops manchester()

Pingback: IPX 364()

Pingback: Walmart Onewire()

Pingback: سكس سحاق عربي()

Pingback: text your ex back pdf()

Pingback: SEO Vancouver()

Pingback: pizza places near me()

Pingback: https://newbizhelp.org/affilistores-review-find-out-what-is-really-up-with-affilistores/()

Pingback: HUNTA 656()

Pingback: daftar joker123()

Pingback: adam and eve sex toys()

Pingback: Mumbai Escorts()

Pingback: sex toy for couples()

Pingback: vibrating bullet sex toy()

Pingback: free download for windows 7()

Pingback: pc games for windows 8()

Pingback: games for pc download()

Pingback: apps for pc()

Pingback: pc games for laptop pc()

Pingback: free app for pc download()

Pingback: apps for windows pc download()

Pingback: best anal sex toys()

Pingback: new rabbit vibrator()

Pingback: Web Forms()

Pingback: milfgilf sex()

Pingback: crazy bulk opiniones()

Pingback: CAWD-016()

Pingback: XVSR 499()

Pingback: Lonzo ball()

Pingback: sewa led screen()

Pingback: زب نار()

Pingback: huge dildo()

Pingback: nipple suckers()

Pingback: hotmail account sign in()

Pingback: penis ring with plug()

Pingback: thrusting vibrators()

Pingback: سکس زوری()

Pingback: mywegmansconnect.com()

Pingback: COURIER PARCEL TO USA()

Pingback: vape shop()

Pingback: Buy vape pen online()

Pingback: anti fog safety glasses spray()

Pingback: download free apps apk for windows()

Pingback: app download for pc()

Pingback: apps download for windows 8()

Pingback: free windows app download()

Pingback: app download for pc()

Pingback: fake pussy()

Pingback: g spot()

Pingback: strapon dildo review()

Pingback: free download for pc windows()

Pingback: download apps apk for laptop pc()

Pingback: pc games for windows 10()

Pingback: neuer Inhalte()

Pingback: web designer()

Pingback: MRSS-076()

Pingback: passive income investing()

Pingback: WANZ 898()

Pingback: Google()

Pingback: Buy weed online()

Pingback: xxx()

Pingback: using rabbit vibe()

Pingback: pc games for windows 8()

Pingback: app download for windows 10()

Pingback: download youtube videos()

Pingback: laptop app()

Pingback: free download for windows 8()

Pingback: free download for windows 8()

Pingback: free apps download for windows 10()

Pingback: buy thc vape juice online()

Pingback: app for pc download()

Pingback: free download for windows 7()

Pingback: free download for windows 10()

Pingback: Vape near me()

Pingback: the vape shop()

Pingback: cash for scrap cars calgary (403) 390-0585()

Pingback: Diamond jewelry vancouver (800) 590-4347()

Pingback: cruises from Sydney()

Pingback: Kary Oh()

Pingback: wie funktioniert mspy()

Pingback: DOCP 175()

Pingback: liteblue()

Pingback: ass gasm()

Pingback: double ended dildo()

Pingback: wireless egg vibe()

Pingback: Fake Money For Sale()

Pingback: erection ring()

Pingback: Buy Counterfeit Money()

Pingback: buy lorazepam online()

Pingback: bullet personal massager()

Pingback: Tarocard()

Pingback: Buy Counterfeit Money()

Pingback: Counterfeit Money For Sale()

Pingback: tv shows()

Pingback: Buy hydrocodone online()

Pingback: free app for pc download()

Pingback: Turkey smm panel()

Pingback: types of mental illness()

Pingback: pc apps for windows xp()

Pingback: fake money that looks real printable for sale()

Pingback: anal sex toys()

Pingback: best sex toys()

Pingback: Pet Express()

Pingback: exotic cart()

Pingback: pc apps for windows 7()

Pingback: Order marijuana online()

Pingback: fake money for sale()

Pingback: THC vape oil discreet shipping UK()

Pingback: classified ads services()

Pingback: ESL teacher jobs()

Pingback: download full version pc games()

Pingback: download free apps apk for pc()

Pingback: free apps download for windows 8()

Pingback: strapon dildo()

Pingback: best realistic dildos()

Pingback: anal plug()

Pingback: Prestige Waterford()

Pingback: asmr()

Pingback: buy viagra()

Pingback: viagra()

Pingback: free download for pc()

Pingback: 1950gSR()

Pingback: bcbudexpress()

Pingback: Ferguson Moving Company North Vancouver()

Pingback: wand massager()

Pingback: female with tattoos()

Pingback: apk download for pc()

Pingback: app apk download for windows 10()

Pingback: apk apps for pc download()

Pingback: apk for windows 10 download()

Pingback: free download for laptop pc()

Pingback: scammer()

Pingback: cheap mattress()

Pingback: cbd for sale()

Pingback: cbd oil for sale()

Pingback: cialis()

Pingback: cialis no prescription()

Pingback: stopoverdoseil.org()

Pingback: vibrator()

Pingback: adam true feel dildo()

Pingback: rechargeable vibrator()

Pingback: app download for pc()

Pingback: convertidormp3()

Pingback: apps apk for windows pc download()

Pingback: Vidalista 40mg()

Pingback: best smm panel()

Pingback: Skincare Regime for dry or dehydrated skin()

Pingback: drywallers Burlington()

Pingback: chain link fencing Langley()

Pingback: male masturbator()

Pingback: vibrating wand()

Pingback: flexible wand()

Pingback: bondage love swing()

Pingback: bondage fantasy()

Pingback: best bondage sex kit()

Pingback: good quiet vibrator()

Pingback: realistic sex toys for men()

Pingback: vibrating penis ring()

Pingback: butt plugs()

Pingback: handheld personal massager()

Pingback: vibrating rabbit sex toy()

Pingback: sex toys for couples()

Pingback: best vibrator to buy()

Pingback: women using vibrator()

Pingback: clone a willy()

Pingback: سکس رمانتیک()

Pingback: Local University()

Pingback: Ansiba Hassan Images()

Pingback: viagra()

Pingback: viagra()

Pingback: viagra()

Pingback: viagra()

Pingback: viagra()

Pingback: viagra()

Pingback: viagra()

Pingback: viagra()

Pingback: viagra()

Pingback: viagra()

Pingback: full version pc games download()

Pingback: dildo()

Pingback: pc games free download for windows 7()

Pingback: pc games for windows 10()

Pingback: pc games for windows 7()

Pingback: apps download for windows 7()

Pingback: free download for windows()

Pingback: pc games for windows 7()

Pingback: New Movies Releasing This Week()

Pingback: VIAGRA()

Pingback: personals()

Pingback: fat removal in jaipur()

Pingback: powerball()

Pingback: spins hack actually works()

Pingback: free v bucks generator()

Pingback: học nghề trang điểm()

Pingback: VIAGRA()

Pingback: FREE V BUCKS()

Pingback: VIAGRA()

Pingback: roblox free robux()

Pingback: porn()

Pingback: anal plug set()

Pingback: naked()

Pingback: học makeup()

Pingback: anal vibrator()

Pingback: tch # HUSTLE()

Pingback: Watch HD movie online for free.()

Pingback: vbx.siterubix.com()

Pingback: best realistic dildo()

Pingback: visacard()

Pingback: kuala lumpur escorts()

Pingback: vibrating bullet panty()

Pingback: anal training()

Pingback: fortnite codes free()

Pingback: coin master spins link today()

Pingback: robux free()

Pingback: v bucks fortnite()

Pingback: chattermeet.com()

Pingback: phishtank warning()

Pingback: prostate sex toy()

Pingback: masturbating everyday()

Pingback: sex()

Pingback: laws()

Pingback: Topmediamarkt()

Pingback: dating()

Pingback: sex()

Pingback: high quality vibrator()

Pingback: kinky()

Pingback: male masturbator toys()

Pingback: asmr vibrations()

Pingback: pizza places near me()

Pingback: dpstreaming()

Pingback: x-rated()

Pingback: sex toys review()

Pingback: buy dildo()

Pingback: best dildos()

Pingback: 먹튀검증 사이트()

Pingback: 먹튀검증 사이트()

Pingback: 먹튀검증 사이트()

Pingback: 메이저놀이터()

Pingback: 바다이야기()

Pingback: 먹튀검증()

Pingback: restaurant menu()

Pingback: pizza coupon codes()

Pingback: SEX()

Pingback: free robux generator()

Pingback: escort directory()

Pingback: bitcoin exchange canada()

Pingback: dong()

Pingback: porn()

Pingback: naked()

Pingback: viagra()

Pingback: chicks()

Pingback: Bond Cleaning()

Pingback: free download for pc windows()

Pingback: 카지노사이트()

Pingback: best cbd capsules()

Pingback: buy cbd oil()

Pingback: male vacuum pump()

Pingback: sex after birth()

Pingback: hot anal toys()

Pingback: gili islands honeymoon()

Pingback: giant dildo()

Pingback: thumping vibrator()

Pingback: End of Lease Cleaning()

Pingback: Cat Supplies Online()

Pingback: casual encounters()

Pingback: viagra pills()

Pingback: VIAGRA()

Pingback: super bowl chicken wings()

Pingback: TylöHelo()

Pingback: Film Streaming()

Pingback: Coca Cola Zero Sugar()

Pingback: Threema Messenger()

Pingback: MVSD 410()

Pingback: buy kstar solar inverter()

Pingback: SSNI 627()

Pingback: https://www.youtube.com/channel/UCdcAvAVLHQ6HLnHkHlGIeHg()

Pingback: cuddle()

Pingback: anal vibrator()

Pingback: legislation()

Pingback: Khmer()

Pingback: peliculas online()

Pingback: Whitney Simmons workout plan()

Pingback: sex videos()

Pingback: teach a kid how to read()

Pingback: pc games for windows xp()

Pingback: app apk download for pc()

Pingback: free download for windows()

Pingback: free apps for pc download()

Pingback: apps for pc download()

Pingback: apps for pc download()

Pingback: free download for pc windows()

Pingback: free download for windows pc()

Pingback: free download for windows pc()

Pingback: free download for windows pc()

Pingback: download app apk for windows()

Pingback: app download for windows 8()

Pingback: apk for pc download()

Pingback: app pc download for windows()

Pingback: free download for windows 10()

Pingback: led lighting()

Pingback: automatic vacuum pump()

Pingback: Chisinau Germania Autocar()

Pingback: asmr tingles()

Pingback: best penis sleeve()

Pingback: software information submitter()

Pingback: Vidalista 20mg()

Pingback: Amsterdam escort()

Pingback: Book a escort()

Pingback: businesses for sale Ontario()

Pingback: best callus remover gel()

Pingback: HND 748()

Pingback: business professional certification()

Pingback: groundwork contractors birmingham()

Pingback: magic massager()

Pingback: how to use dual vibrator()

Pingback: pocket pussy()

Pingback: clit toys()

Pingback: loadcentral retailer()

Pingback: steroids for sale()

Pingback: all my sex toys()

Pingback: thrusting vibe()

Pingback: sex toys faqs()

Pingback: an sang ngon quan 3()

Pingback: Famous hunters()

Pingback: GENM 023()

Pingback: sous traitance publissoft france()

Pingback: commercial flourmill()

Pingback: blackboard uq()

Pingback: beginner dong()

Pingback: breakfast restaurant near me()

Pingback: best restaurants()

Pingback: mimblewimble excess()

Pingback: https://locationsnearmenow.net/()

Pingback: search engine optimization services in uk()

Pingback: easy crm free()

Pingback: Karatbars paychecks()

Pingback: VIAGRA()

Pingback: MyMathLab answers()

Pingback: Contract Security Services()

Pingback: bitcoin investment trusted sites()

Pingback: travel news and tips()

Pingback: FROTNITE GLITCH()

Pingback: roblox download()

Pingback: app free download for windows 7()

Pingback: pc games for windows 10()

Pingback: pc games for windows 8()

Pingback: full version pc games download()

Pingback: anal dildo()

Pingback: couples massager()

Pingback: #photoshoot()

Pingback: descargasmix()

Pingback: dildo challenge()

Pingback: giant dildo()

Pingback: asmr masturbating()

Pingback: double dildo()

Pingback: asmr massage()

Pingback: Digitization Services()

Pingback: american airlines tickets()

Pingback: Cheap pbn backlinks()

Pingback: buy pbn backlinks buy google reviews()

Pingback: buy backlinks ppbn trackback seo blackhat()

Pingback: buy pbn links and facebook usa likes()

Pingback: Face()

Pingback: bullet vibe()

Pingback: 메이저토토()

Pingback: coconut coir()

Pingback: Donovan()

Pingback: rotating rabbit vibrator review()

Pingback: classic vibrator review()

Pingback: 123movies()

Pingback: s&m toys()

Pingback: spoon flower()

Pingback: Buy blackhat SEO()

Pingback: bariatric surgery cost()

Pingback: rabbit ear vibrator()

Pingback: rocks off()

Pingback: 더킹카지노()

Pingback: 퍼스트카지노()

Pingback: 우리카지노()

Pingback: recipes()

Pingback: 코인카지노()

Pingback: 예스카지노()

Pingback: airline tickets()

Pingback: realistic masturbator()

Pingback: prostate massager()

Pingback: SEX()

Pingback: CHEAP VIAGRA()

Pingback: web designing()

Pingback: Los Angeles()

Pingback: Pizza near me()

Pingback: viagra online()

Pingback: female dildo()

Pingback: uk package forwarder()

Pingback: oral masturbator()

Pingback: zwrot prowizji()

Pingback: CBD oil for pain()

Pingback: bank / bankowa()

Pingback: luxury sex toys()

Pingback: clitoral stimulation()

Pingback: photographer in surat()

Pingback: porn()

Pingback: magic wand massager()

Pingback: Dog Bandanas()

Pingback: FREE ROBUX()

Pingback: powerful air freshener()

Pingback: https://moz.com/community/users/13840489()

Pingback: first timers strap on()

Pingback: jelly dildo()

Pingback: dhgate coupon()

Pingback: buy phen375()

Pingback: digital marketing agency hong kong()

Pingback: silicone rabbit vibrator()

Pingback: clit massager()

Pingback: best silicone dildo()

Pingback: Ford EcoSport Bình Dương()

Pingback: realistic masturbator()

Pingback: Grey Cup 2019 Live Stream()

Pingback: thrusting vibe()

Pingback: frozen 2()

Pingback: House for sale()

Pingback: Press release distribution Fiverr()

Pingback: apk download for windows 10,()

Pingback: free windows app download,()

Pingback: free app for pc download,()

Pingback: pc app,()

Pingback: best cbd oil for pain()

Pingback: Online Fashion Store for men and women.()

Pingback: CHEAP VIAGRA ONLINE()

Pingback: best cbd oil for pain()

Pingback: cowgirl sex toy machine()

Pingback: adam and eve dildo()

Pingback: vibrating stroker()

Pingback: anal play()

Pingback: high quality vibrators()

Pingback: best cbd oil for pain()

Pingback: شركة ديكورات()

Pingback: best cbd oil for pain()

Pingback: best cbd oil for pain()

Pingback: anal vibe()

Pingback: TORRENT PORN DOWNLOAD()

Pingback: CHEAP VIAGRA()

Pingback: CHEAP VIAGRA()

Pingback: best penis extender()

Pingback: ETORRENT PORN()

Pingback: robux giveaway()

Pingback: gamesfriv()

Pingback: Hot Stamp Ribbon()

Pingback: viagra men()

Pingback: FREE PORN()

Pingback: cbd oil for anxiety()

Pingback: SEO()

Pingback: best cbd for sleep()

Pingback: simple call center software()

Pingback: giày adidas()

Pingback: pest control services bradford()

Pingback: pest control newmarket ontario()

Pingback: CHEAP VIAGA()

Pingback: Anime Batch()

Pingback: VIAGRA()

Pingback: apps download for windows 7()

Pingback: free games download for pc()

Pingback: apps download for windows 7()

Pingback: games for laptop download()

Pingback: apk for pc download()

Pingback: https://searchtempo.com.au/()

Pingback: app download for windows 7()

Pingback: PORN VIDEOS DOWNLOAD()

Pingback: app for pc free download()

Pingback: apps for pc download()

Pingback: داستان سکسی()

Pingback: Teo()

Pingback: Obrus()

Pingback: Bajkonur()

Pingback: vibrating dongs()

Pingback: anal sex toys()

Pingback: silicone rabbit vibrator()

Pingback: sailboat charter italy()

Pingback: discreet bullet vibrator()

Pingback: male sex toys()

Pingback: adam & eve scarlet strap-on starter set()

Pingback: LEGO 70421()

Pingback: best cbd oil for depression()

Pingback: cbd oil for sleep()

Pingback: adam’s silicone dildo()

Pingback: how to use a vibrating cock ring()

Pingback: biography wiki()

Pingback: YOLO PORN()

Pingback: lớp học trang điểm cá nhân()

Pingback: bluemotion nex 1()

Pingback: adam and eve g gasm rabbit()

Pingback: VIRAL SEX()

Pingback: vibrating butt plug()

Pingback: twitter'dan @rajapandi_ss (stormlikes.net 'in sahibi) twitter'dan bedava gay porno izle()

Pingback: silicone anal beads()

Pingback: best sex swings()

Pingback: p spot vibe()

Pingback: belladona pocket pussy()

Pingback: remote control panty vibe()

Pingback: vibrating anal plug()

Pingback: bunny sex toy()

Pingback: best g spot vibrator()

Pingback: restaurants near me()

Pingback: Apostle Joshua Selman()

Pingback: cvs near()

Pingback: storeholidayhours.org()

Pingback: SEX DALLS()

Pingback: nigéria newspapers read them online()

Pingback: walmart one()

Pingback: best smart display()

Pingback: ROBUX GENERATOR()

Pingback: Naija()

Pingback: adam and eve sex toys()

Pingback: bunny sex toy()

Pingback: diabetes surgery()

Pingback: puppy training()

Pingback: SSNI-672()

Pingback: ABP 938()

Pingback: terjemahan()

Pingback: triple pleasure rabbit()

Pingback: blog()

Pingback: SEX()

Pingback: test for legionella()

Pingback: 더나인카지노()

Pingback: mini bullet vibe()

Pingback: adam and eve strap on()

Pingback: VePorn.com()

Pingback: MKMP 315()

Pingback: comprar aceite de cbd()

Pingback: Son()

Pingback: 예스카지노()

Pingback: 퍼스트카지노()

Pingback: 더나인카지노()

Pingback: champion rottweilers()

Pingback: 우리카지노()

Pingback: 더킹카지노()

Pingback: waterproofing paint for roof()

Pingback: 코인카지노()

Pingback: Which()

Pingback: CCRMG()

Pingback: FREE SEX()

Pingback: best male stroker()

Pingback: dildo()

Pingback: pleasure ring for men()

Pingback: https://images.google.ps/url?q=httpsphongkhamhana.com()

Pingback: Rottweiler puppies for sale in LA()

Pingback: sexy()

Pingback: sexlive()

Pingback: Roadside assistance()

Pingback: powerdirector app()

Pingback: FCMB Mobile Banking()

Pingback: online research repository()

Pingback: Google()

Pingback: canadianpharmacystorm.com()

Pingback: anal toy()

Pingback: clit sucking vibrator()

Pingback: bunny vibrator()

Pingback: clit sex toy()

Pingback: remote panty vibrator()

Pingback: masturbator toys for men()

Pingback: LEVITRA CHEAP()

Pingback: bunny vibrator()

Pingback: DRUGS()

Pingback: Melanie Bowen()

Pingback: cock ring review()

Pingback: Fantasy Whip()

Pingback: cheap anal lubricant()

Pingback: pleasure ring()

Pingback: women’s lingerie()

Pingback: genericvgrmax.com()

Pingback: latin ass()

Pingback: newborn photography()

Pingback: vector art conversion()

Pingback: https://www.isaacroyston.com/()

Pingback: rc shop online()

Pingback: Buy ketamine crystals online()

Pingback: Xanax for sale()

Pingback: Tourism In Nigeria()

Pingback: 710 king pen()

Pingback: online research library()

Pingback: Adipex online()

Pingback: anal butt plugs()

Pingback: 710 king pen()

Pingback: clit massager()

Pingback: how to masturbate using dildo()

Pingback: remote control panties()

Pingback: viagrawithoutdoctorspres.com()

Pingback: best vibrating wand()

Pingback: san diego personal trainer()

Pingback: strapon dildo()

Pingback: official site()

Pingback: داستان سکسی()

Pingback: digital marketing services in thane()

Pingback: magic store()

Pingback: popeyes menu prices()

Pingback: official website()

Pingback: chinese takeaway()

Pingback: myaccountaccess()

Pingback: canpharmb3.com()

Pingback: how to get more instagram followers()

Pingback: netprobk()

Pingback: pesni pro sneg()

Pingback: pesni teksty()

Pingback: tshhitsja()

Pingback: best cbd oil for pain()

Pingback: adam and eve vibrators()

Pingback: viapwronline.com()

Pingback: Age()

Pingback: suits hoodie Jump suit plus size dressestailor near mebespoke()

Pingback: bookstore()

Pingback: handbags for women()

Pingback: increase DR()

Pingback: electric motorcycles()

Pingback: Zügeln()

Pingback: jetsurf()

Pingback: https://cryptocurrencyinafrica.site/()

Pingback: https://blockchainafrica.site/()

Pingback: https://cryptocurrencyafrica.icu/()

Pingback: walmart wire()

Pingback: hotmail inbox()

Pingback: سکس()

Pingback: disability insurance()

Pingback: prostate milking sex toy()

Pingback: bullet egg()

Pingback: best cbd oil for pain()

Pingback: science camp program()

Pingback: best cbd gummies()

Pingback: Nigeria()

Pingback: WAEC Registration()

Pingback: Odogwu Blog()

Pingback: Nigeria Newspaper()

Pingback: Anambra News()

Pingback: TADACIP (1X4)()

Pingback: Download Naija Songs()

Pingback: app free download for windows 10()

Pingback: sex toys()

Pingback: apk for pc download()

Pingback: app pc download for windows()

Pingback: app download for windows 7()

Pingback: free download for pc windows()

Pingback: games for pc download()

Pingback: free download for windows pc()

Pingback: pc games for windows 10()

Pingback: free download for windows()

Pingback: a fantastic read()

Pingback: app apk download for windows 8()

Pingback: app download for pc()

Pingback: sous traitance web()

Pingback: sous traitant web canada()

Pingback: pc games for windows 10()

Pingback: apk for pc free download()

Pingback: free download for pc()

Pingback: Dank vapes()

Pingback: strap on dildo()

Pingback: realistic dildo()

Pingback: rabbit vibe()

Pingback: sous traitance web()

Pingback: Outsourced Hosting Support()

Pingback: https://merrydrug.net/()

Pingback: sloths at st louis aquarium()

Pingback: best cbd capsules()

Pingback: cbd oil near me()

Pingback: ehlers danlos syndrome()

Pingback: best cbd oil for anxiety()

Pingback: best cbd oil for sleep()

Pingback: best cbd gummies()

Pingback: best cbd oil for pain()

Pingback: Super fast money()

Pingback: https://cleaningserviceofdc.com()

Pingback: Pressure Washing()

Pingback: https://penzu.com/p/e9bf4b19()

Pingback: buy potassium cyanide()

Pingback: jack brown invest islands()

Pingback: self lubricating masturbator()

Pingback: THE CAMERA GUYS()

Pingback: personal wand massager()

Pingback: rechargeable finger vibe()

Pingback: penis extender sleeve()

Pingback: giant dildo()

Pingback: pressure washing services()

Pingback: web design widnes()

Pingback: Water Coolers()

Pingback: bikini photoshoot()

Pingback: Porn Download()

Pingback: dildo()

Pingback: "weight loss"()

Pingback: pheromones for women()

Pingback: butt plugs reviews()

Pingback: download pornd on connectivasystems()

Pingback: Free Ads()

Pingback: prepaidgiftbalance()

Pingback: hack credit cards()

Pingback: نقل عفش()

Pingback: xnxx()

Pingback: Free Ads Kenya()

Pingback: here()

Pingback: cbd()

Pingback: Quit smoking()

Pingback: trading Kensington()

Pingback: rechargeable rabbit()

Pingback: 710 King Pen()

Pingback: Marijuana Strains()

Pingback: Legal Marijuana Store()

Pingback: Oxycontin Online()

Pingback: container cabin()

Pingback: mobile massage therapist()

Pingback: Game Poker Seru()

Pingback: Get it now()

Pingback: target view schedule()

Pingback: list of marijuanas stocks canada()

Pingback: satta king youtube bazar()

Pingback: ary dramas()

Pingback: limelight lawn 2020()

Pingback: Cool gifts()

Pingback: vibrating butt plug()

Pingback: fetish bondage swing()

Pingback: increase DR fast()

Pingback: viagra()

Pingback: Szkolenie okresowe w dziedzinie bhp i ppoz dla kadry inzynieryjno technicznej()

Pingback: viagra()

Pingback: viagra()

Pingback: viagra()

Pingback: best tea for weight loss and bloating()

Pingback: Domenica Mijares()

Pingback: viagra()

Pingback: cannabis oil for pain()

Pingback: cananbis oil()

Pingback: hemp()

Pingback: UnseenMMS()

Pingback: Rick Simpson Oil()

Pingback: Stiiizy Pods()

Pingback: Promethazine Syrup()

Pingback: Benefits of Vaping()

Pingback: Buy Weed Online()

Pingback: Pound of Weed()

Pingback: streaming markets data()

Pingback: reshp porn()

Pingback: adam and eve()

Pingback: Patient Caretaker in Noida()

Pingback: Buy Weed Online()

Pingback: Joel Osteen Messages()

Pingback: Joel Osteen MP3 Sermons()

Pingback: Official Website Joel Osteen()

Pingback: نقل عفش()

Pingback: google maps seo services()

Pingback: agence digitale paris()

Pingback: agence digitale paris()

Pingback: buy cbd gummies()

Pingback: cbd()

Pingback: cannabidiol oil()

Pingback: cannabidiol oil for sale()

Pingback: cannabidiol()

Pingback: аудиокниги для малышей бесплатно()

Pingback: ищу работу в нью йорке()

Pingback: www.headquarterscomplaints.com/tm-menards-login()

Pingback: buy hacklink()

Pingback: SEO()

Pingback: fda supplements facility()

Pingback: online digital marketing courses()

Pingback: Logo design services()

Pingback: Jewelry()

Pingback: Corredurias en Cancun()

Pingback: matrushka()

Pingback: buy instagram followers()

Pingback: hacksaw blades manufacturers()

Pingback: top sex toys()

Pingback: Windsor Entertainment()

Pingback: LogoDaliL Egypt Business Directory()

Pingback: Blue Dream Strain()

Pingback: marble()

Pingback: barbers apron()

Pingback: kanmani anbodu lyrics()

Pingback: how to get free robux()

Pingback: INDIA VISA()

Pingback: past life analysis()

Pingback: best smm panel in world()

Pingback: cool tech accessories()

Pingback: good lawyer()

Pingback: Unlimited directadmin hosting()

Pingback: indian visa online()

Pingback: india visa application()

Pingback: Order oxycodone online legally()

Pingback: Buy xanax online()

Pingback: https://www.liveinternet.ru/users/albert_crane/post465566710()

Pingback: Toronto graphic designer()

Pingback: telnyashka()

Pingback: sell my trailer fast()

Pingback: gls training()

Pingback: virtual visa card buy for google AdWords()

Pingback: where to buy medical cannabis oil online()

Pingback: Cyber Security Expert in India()

Pingback: Catolux()

Pingback: Political memes()

Pingback: buy edibles online ship anywhere()

Pingback: các sàn forex()

Pingback: big dildo()

Pingback: steroids for sale uk()

Pingback: MrPornGeek()

Pingback: leather harness()

Pingback: http://www.listylocal.com/business/home-and-garden/mold-removal-akron()

Pingback: https://www.cgmimm.com/ohio/akron/home-inspector/mold-removal-akron()

Pingback: http://www.thebrewlink.com/united-states/bakersfield/home-repair/mold-removal-bakersfield()

Pingback: acne cream()

Pingback: electrician near me()

Pingback: cbd oil near me()

Pingback: http://www.localfeatured.com/Directory/ListingDisplay.aspx?lid=8126#.Xbe435L7TIU()

Pingback: buy customised myob accountright receipt()

Pingback: fapidy.com()

Pingback: VoIP Phones()

Pingback: Refacciones electronicas()

Pingback: Medical Marijuana()

Pingback: тест на дюзи()

Pingback: private chef()

Pingback: http://uso-kogalym.ru/profile.php?lookup=15793()

Pingback: mildew()

Pingback: free video streaming()

Pingback: Elektroschrott kostenlos Abholen()

Pingback: full spectrum CBD oil()

Pingback: RoyalCBD.com()

Pingback: iPhone X Phone Screen()

Pingback: buy hemp CBD online()

Pingback: lyrics hindi songs free download()

Pingback: free download for windows pc()

Pingback: games for laptop download()

Pingback: pc games free download for windows 7()

Pingback: free download for windows pc()

Pingback: games apps for pc download()

Pingback: pc games for windows 8()

Pingback: free download for windows 8()

Pingback: Dank cartrifges()

Pingback: Abbyy Finereader Crack()

Pingback: Double penetration()

Pingback: sildamax uk()

Pingback: Elite IT()

Pingback: strap on dildo()

Pingback: is CBD legal()

Pingback: Royal CBD()

Pingback: mua nhà quy nhơn()

Pingback: kink()

Pingback: Avilla Indiana()

Pingback: Wand Massager Review()

Pingback: https://diamondcleaningusa.com/cleaning-methods/()

Pingback: Royal CBD()

Pingback: corgi breeders near me()

Pingback: best crm for architecture firms()

Pingback: fundmerica california()

Pingback: CBD oil for pain()

Pingback: furniture shops in gurgaon()

Pingback: buy CBD products()

Pingback: buy CBD oil near me()

Pingback: how to masturbate()

Pingback: 1 Pro moving company Vancouver (604) 721-4555()

Pingback: https://myinforms.com/()

Pingback: scarlet macaw for sale()

Pingback: waterproofing mumbai()

Pingback: ویدیوی سکسی افغانی هراتی()

Pingback: Buy Weed Online()

Pingback: honeymoon to dubai packages()

Pingback: c4 healthlabs cbd oil()

Pingback: is cbd oil legal()

Pingback: cbd oils()

Pingback: how to masturbate using pocket stroker()

Pingback: adam and eve sex toys()

Pingback: детская литература в сша()