When Insiders Trade, the Market Listens

Insider trading is a term that probably makes most American’s blood boil. Scenes of villains like Martha Stewart being privy to impactful information and selling as to not incur loss, while the average American loses when news of the FDA rejecting ImClone’s proposed cancer drug fill their minds. She is not the only case of this happening. It has happened, and will happen again, as long as someone is willing to risk their freedom for financial gain.

The reality is, though, that this is a rather common place activity in the market. Any time an exchange of securities takes place in the market by someone with substantial influence in an organization, either high ranking employee, board member or anyone who holds 10% or greater of the company’s shares, a Form 4 must be filed with the SEC. What many investors might not realize is that these forms can tell a story about what is going on in the organization.

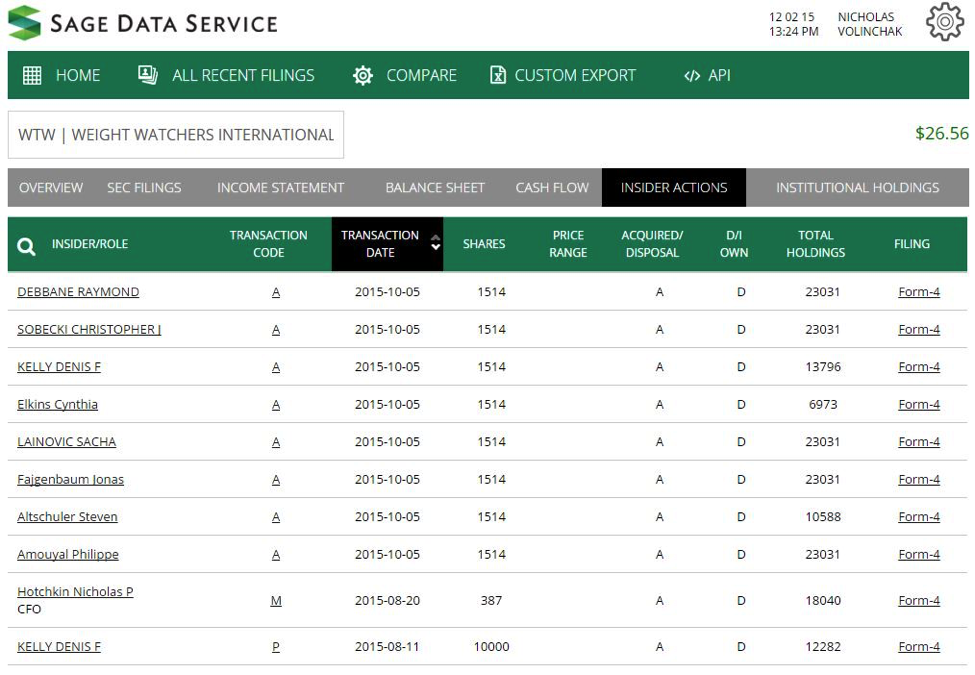

Let’s take a look at the Form 4’s filed by insiders at Weight Watchers International, Inc.:

What you can see is eight transactions, all acquisitions of stock, taking place on 10/05/2015. There are a variety of circumstances which would cause insiders to buy or sell stock, but so many doing it on one date signifies to me that they believed the stock was undervalued. There, again, could be a variety of reasons why they believe it to be undervalued, from expected revenues being higher than expected or some extraordinary circumstance.

Just 2 weeks later, it was announced that Oprah was paying $43 million dollars for a 10% share of the company. The next two days saw the company’s stock price jump over 300%. The market sentiment really had a wild swing resulting from Oprah’s involvement, but the signals were there to be seen if you were cunning enough to follow what the insiders of the company were doing. If the insiders executed transactions acquiring the stock, and eight of them did it, it stands to reason there was a good reason to do so.

So often the emphasis of investing is put on the technical financial analysis of an organization. The reality is there are a variety of ways one can valuate a company, both in the short and long term. It is an old quote, but it fits the part quite well: there is more than one way to skin a cat. I think that is good advice to live by if you are involved in the stock market.

Sorry, the comment form is closed at this time.